Decoding IRS Penalty Letters: A Look at Common ACA Non-Compliance Letters

Understanding IRS penalty letters for ACA non-compliance is crucial for businesses to navigate complex regulations. By having a firm grasp of Affordable Care Act (ACA) rules and regulations, your HR team feels empowered to address issues promptly, avoid penalties, and confidently ensure compliance across the organization.

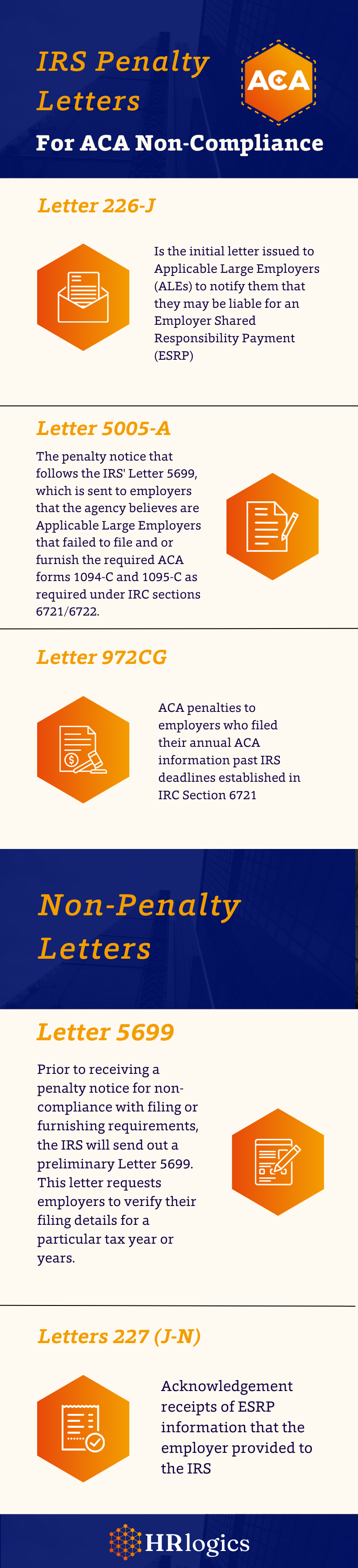

This infographic breakdown provides invaluable insights into the key

IRS penalty letters your HR team needs to know about, including

Letter 226-J, Letter 5005-A, and Letter 972CG for ACA noncompliance penalties, as well as non-penalty letters like Letter 5699 and Letters 227 (J-N).

Partner with HRlogics for ACA Compliance Confidence

HRlogics ACA was the first technology company to help employers tackle the complex landscape of healthcare and employment reporting and compliance and remains the industry leader in expert customer care. Our innovative Clear ACA software streamlines the process effortlessly with a self-service option, employing advanced technology and a user-friendly interface. Total ACA by HRlogics transcends being only software; it’s your ally in ACA compliance management, offering expert guidance, proactive assistance, and continuous monitoring to minimize IRS penalties by a tenured ACA expert.

Have Questions or Need More Information?

We will get back to you as soon as possible.

Please try again later.

HRlogics